Services

At ALLIANCE Credit Union, we’re committed to making your financial life easier. Explore our range of services designed to help you save, borrow, grow, and manage your money with confidence—no matter where life takes you.

Wherever your life takes you,

ALLIANCE is right there with you.

OVERDRAFT PROTECTION

Life Happens – We’re Here to Help

Unexpected expenses or timing issues can leave your checking account short. That’s where our overdraft options come in—so you don’t have to worry about declined payments or hefty return-check fees.

Your Overdraft Coverage Options

Overdraft Protection

· If you have money in another ALLIANCE account, we’ll transfer it to your checking account when needed.

· No transfer fee.

Courtesy Pay

· Courtesy Pay helps cover transactions when your checking account does not have enough money.

· If you don’t have funds available in another ALLIANCE account, Courtesy Pay may cover your transaction based on your recent direct deposits.

· We may cover up to 75% of your total direct deposits from the previous 35 days, up to a maximum of $1,000.00.

· Courtesy Pay may be used for checks, automatic payments, recurring debits, and more up to your approved limit.

· A fee applies each time we pay an overdraft item.

· Courtesy Pay can be stopped at any time if it is being overused or abused.

Optional Coverage for Debit Card/ATM Transactions

· By default, we don’t cover ATM transactions or one-time debit card purchases with Courtesy Pay unless you ask us to.

· If you want this additional coverage, contact us to let us know. You can revoke your coverage selection at any time by contacting us in writing or by phone.

How Much It Costs You

- A fee of $24 is charged each time we pay an overdraft transaction.

- A $3 daily negative balance fee is charged if your balance is negative at the end of the day. This applies each business day until you bring your account back to a positive balance.

- A $24 NSF (non-sufficient funds) fee for each item we’re not able to cover and that gets returned.

- There is no maximum number of overdraft or NSF fees that may be charged.

Who Qualifies for Courtesy Pay

- Courtesy Pay is available on personal checking accounts with a recurring direct deposit of at least $500 per month.

- Your account must return to a positive balance at least once every 35 days.

- Courtesy Pay is discretionary. We are not required to cover every overdraft, and some transactions may be declined.

Important Things to Know

- We do our best to cover overdrafts, but we don’t guarantee that every transaction will be paid.

- You can opt in or opt out of optional coverage for ATM and debit card transactions any time by contacting us.

- Use online or mobile banking to track your balance—staying aware helps you avoid costly overdrafts altogether. (Good account management is always your best protection.)

e-ALERTS

Your car’s fuel gauge lets you know when you’re almost out of gas. Your smartphone lets you know when your battery is losing its charge. So wouldn’t it be nice if you got instant info when your ALLIANCE checking account is running low? Sure, we can make that happen.

When you sign up for eAlerts, you receive timely messages from us about your transactions. In addition to account balances, you can find out when deposits are ready for your use and when checking payments have cleared. You can even sign up for personal reminders about bill due dates and other important tasks—because, hey, you’re busy, and we have plenty of time to keep in touch.

eAlert Set Up

- Log in to Online Banking.

- Open the Main Menu (three stacked lines).

- Select eAlerts under Services.

- Choose your notification preferences.

eAlert Maintenance

- Log in to Online Banking.

- Open the Main Menu (three stacked lines).

- Select eAlerts under Services.

- Choose the alert you want to delete or click New eAlert to create a new one.

- Use the drop-down menus to set up or adjust your alert.

ONLINE BANKING

Enroll in Online Banking

It’s an incredible convenience to be able to manage your money 24/7 from your home, office, or anywhere life takes you.

- Sign up right here on our website

- Visit a branch if you need more help

- Security safeguards protect your financial data

BILL PAY

Because your time is better spent on other things

Your idea of a perfect evening might involve binging on a favorite show or chowing down with friends on some tasty Texas barbecue. Sitting down with a checkbook and a batch of bills is probably pretty low on the list. ALLIANCE can help you cut that monthly chore down to size.

Our online Bill Payer service lets you pay everything you owe in a matter of minutes. Make quick work of one-time charges or schedule payments of recurring bills – like utilities – well in advance. That means you won’t miss any more due dates – or miss out on any more fun with your friends.

- Access Bill Payer through Online Banking

- Make payments any hour of the day or night

- Easy scheduling helps reduce the risk of late payment fees

- No charge if you make three or more payments per month (otherwise, a $5 fee will be assessed)

- Security safeguards protect your private financial information

MOBILE BANKING

Let’s help your smartphone reach its full potential

Downloading tunes, taking photos, texting friends. Your phone can do a lot of things, though not all are of equal importance. But tracking your finances and moving money where it needs to go is way up there on any priority list. And that’s what makes the ALLIANCE Mobile App special.

No matter where you are in Texas or beyond, you can use your fast fingers to access your accounts without missing a beat. This service is free to our members and works perfectly fine with those fancy smart watches as well. Which only seems fitting, since our Mobile App is so good at saving you time.

- Mobile banking services available 24/7

- Check your account balances

- Pay your bills in a matter of minutes

- Transfer funds between accounts

- Deposit checks using your phone or tablet camera

- View a list of recent transactions

ALLIANCE CU Mobile Banking.

For assistance with deleting your ALLIANCE internet banking profile, please call (806) 798-5554.

Please note: deleting your internet banking profile will not close your ALLIANCE account(s).

Remote Deposit Capture

Deposit checks quicker than ever.

Here’s the deal: When your boss hands you a paycheck or a friend or relative writes you a personal check, it’s not really money. Not until you get the funds into your ALLIANCE account. And since your life keeps you on the run, sometimes it’s hard to find time to stop in and make a deposit.

But modern technology provides an easy solution. All our members need to do is download our Mobile App, take photos of the front and back of their check, and use the easy instructions to zip them on over to us. Your money will reach your account faster, and from there we’re sure you’ll need no instructions on how to spend it.

- Download our free Mobile App from GooglePlay or the Apple Store

- Deposit checks any hour of the day using your phone or tablet camera

- User-friendly instructions help you finish up in just a few minutes

- Get fast electronic confirmation of your deposit

- Gain access to your money in a day or two in most cases

- Security safeguards prevent your private information from being revealed

e-statements

Go Paperless!

At ALLIANCE, your security is our highest priority. In today’s digital, fast-paced world, we understand the importance of staying current and secure. By switching to paperless enrollment, you can protect your information from identity theft and eliminate the risk of mail fraud. Enjoy faster access to your statements, easier management with all your documents in one place, and contribute to a healthier environment by reducing paper usage. Join us in safeguarding your account and switch to paperless today!

Environmentally Friendly:

Reducing the usage of paper helps to save trees and conserve the environment.

Easier to Manage:

Statements are stored in one place, eliminating the clutter of physical papers.

Protect Your Information:

Paperless statements can reduce the chances of identity theft, eliminating the risk of mail theft and ID theft.

Faster Access:

Your statement is available as soon as it’s processed, letting you access it faster than waiting for mail delivery.

Save Money:

Effective August 30, 2024, members will be charged a $3.50 fee for paper statements.

How to enroll in E-Statements today!

Use our Online Banking to

Go paperless!

- Login to our Online banking platform

- Click “Settings”

- Select “Edit Email”

- Select the Statement option

Use our Mobile App to

Go paperless!

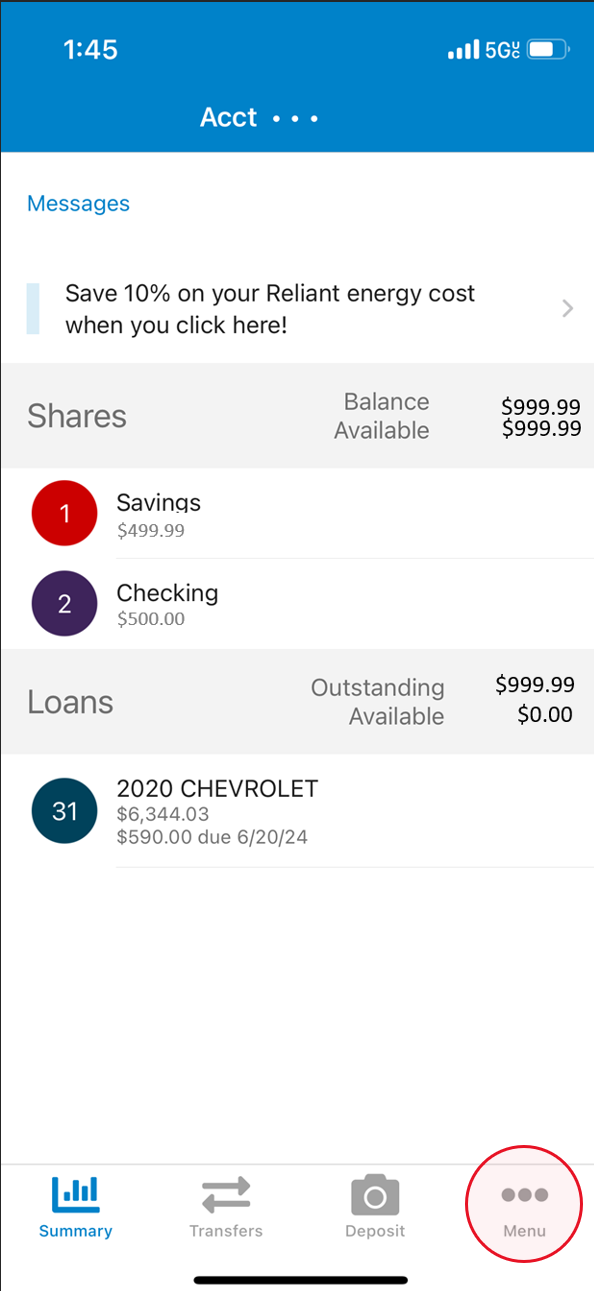

Step 1:

Open ALLIANCE CU app and click "More"

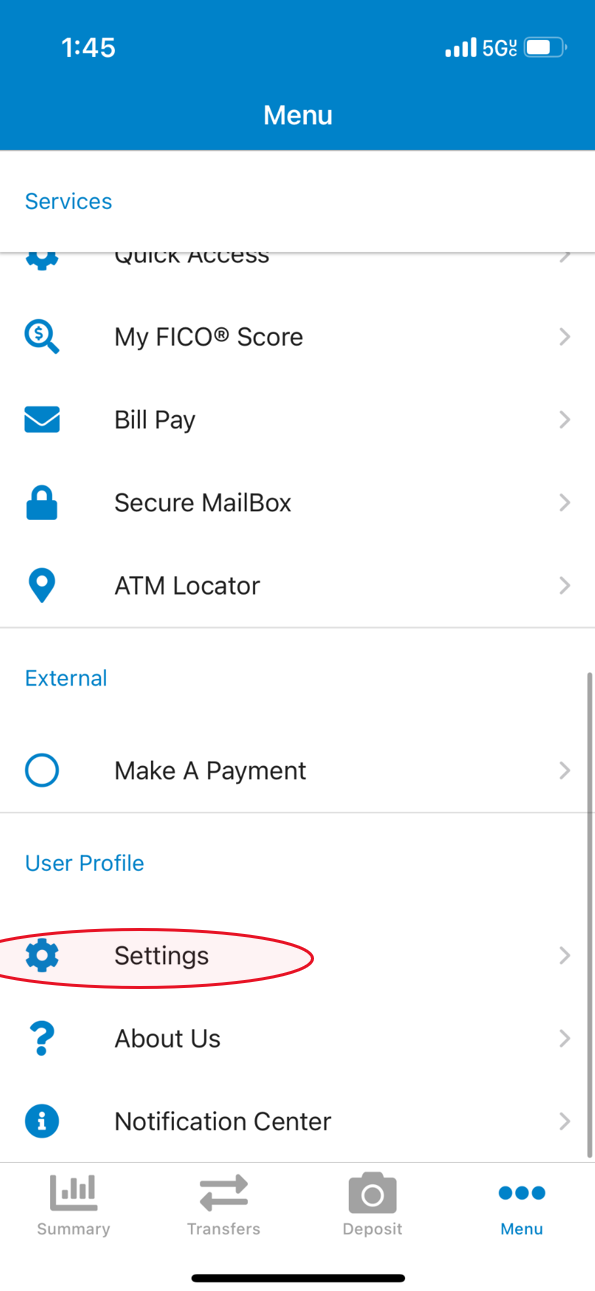

Step 2:

Scroll down and click "Settings"

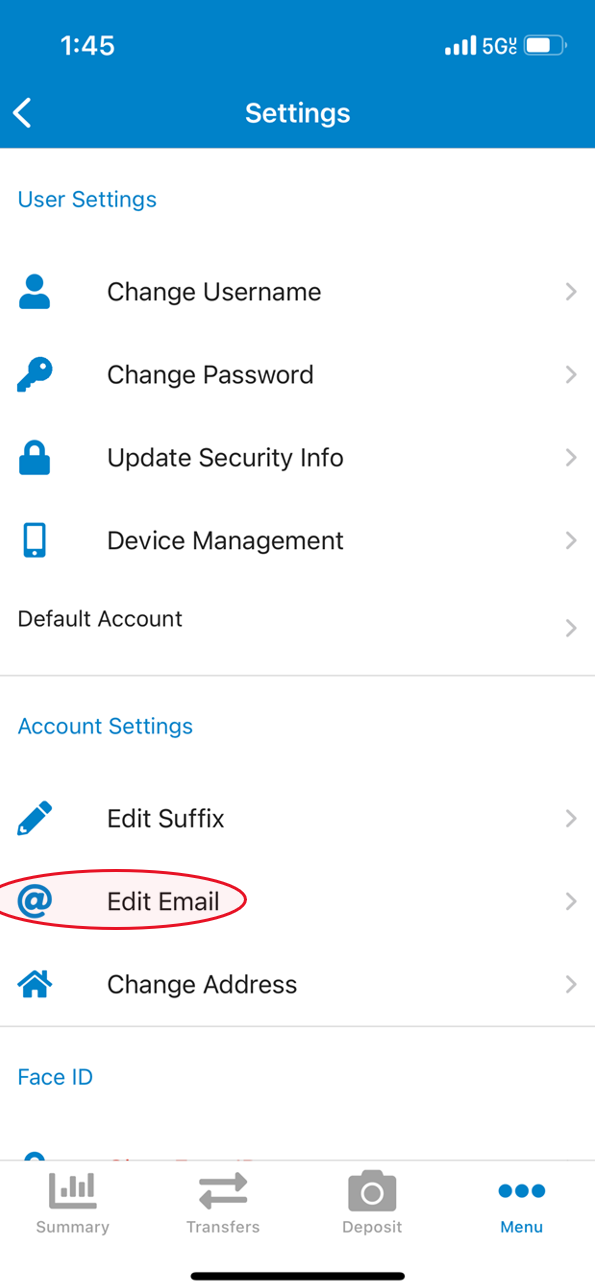

Step 3:

Now find and click "Edit Email"

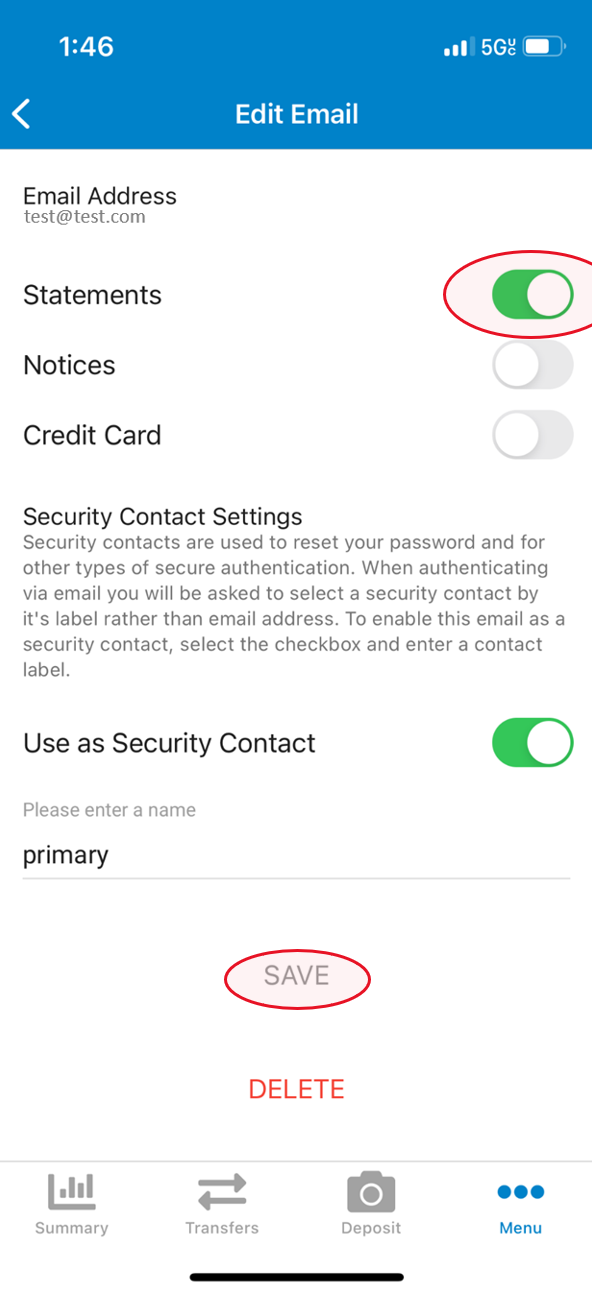

Step 4:

Add a new email or update settings of an existing email

Step 5:

Turn on Statements and Save

Find a Location Near you

We can't wait to see you

Calculators

Convenient and easy to use, our calculators provide good data to make better decisions.

Education

Access our Financial Education articles for the most important financial decisions of your life.

Rates

Save more on your mortgages and other loans. Better rates, better future, better life.